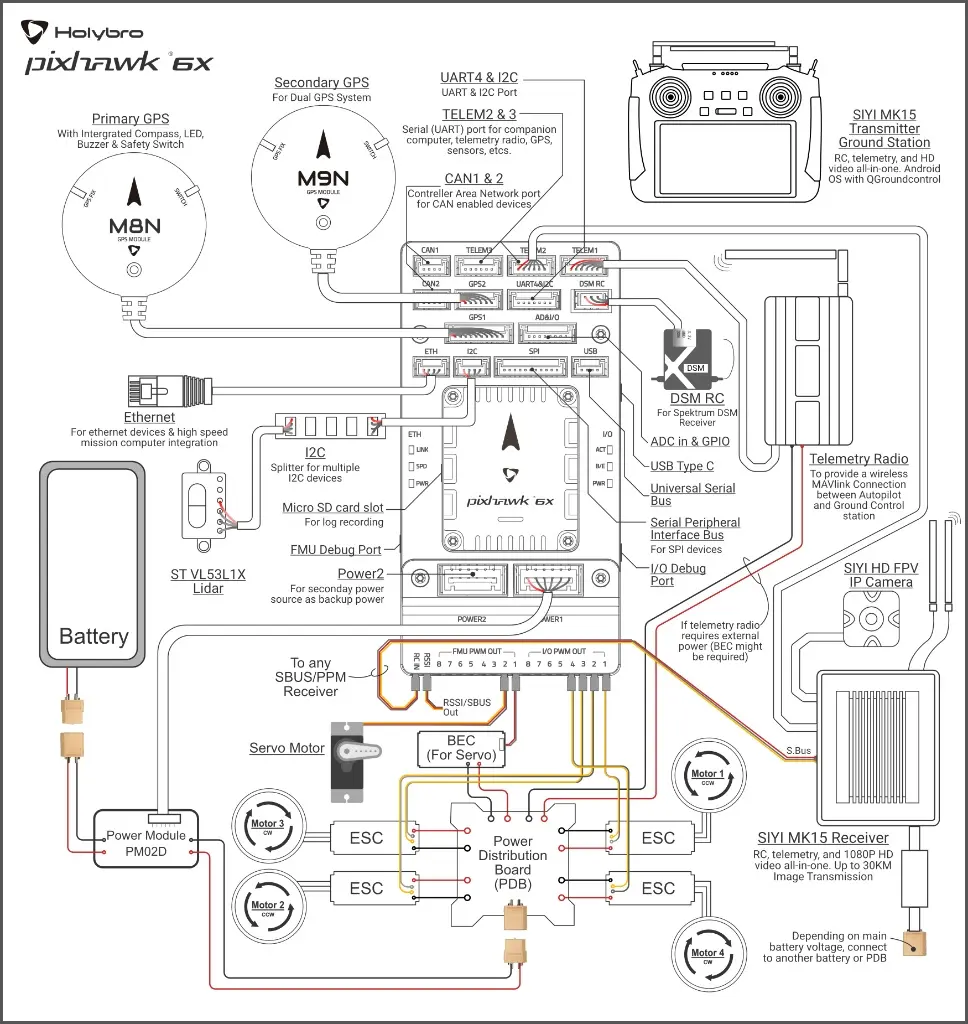

A modern professional drone is a marvel of integration. Looking at a standard wiring diagram for a high-end autopilot system reveals a complex web of dozens of components: GPS modules, lidar sensors, long-range telemetry radios, heavy-lift motors, and redundant power systems.

For drone manufacturers and system integrators, that diagram isn't just a technical schematic—it’s a map of a global, highly interdependent supply chain. Understanding where these critical components originate, the risks involved, and the emerging alternatives is essential for building resilient drone businesses in 2025 and beyond.

This analysis deconstructs the UAV supply chain ecosystem and spotlights the shift toward diversification, including the rise of Southeast Asia as a manufacturing alternative.

Deconstructing the UAV Ecosystem: Critical Dependencies

To understand the supply chain, we must break down the drone into its core component categories, as illustrated by typical high-end integration diagrams.

1. The "Brain": Flight Controllers and Silicon

At the heart of every drone is the autopilot. While the printed circuit board (PCB) might be assembled anywhere, the critical components—high-speed microcontrollers (MCUs) like STM32 chips, triple-redundant IMUs (gyroscopes and accelerometers), and barometers—are semiconductor-based.

- Supply Chain Reality: The design of these chips is often Western (US/Europe), but fabrication is heavily concentrated in leading foundries in Taiwan and East Asia. Global semiconductor shortages directly impact autopilot availability.

2. The "Muscle": Propulsion Systems

Motors and Electronic Speed Controllers (ESCs) define a drone's payload capacity.

- Supply Chain Reality: High-performance brushless motors rely heavily on strong neodymium magnets. The supply chain for rare-earth elements required for these magnets is overwhelmingly dominated by China for both mining and processing.

3. The "Nervous System": Connectivity and Positioning

This includes multi-constellation GNSS (GPS) receivers, long-range video/data telemetry links, and networking hardware like Ethernet switches.

- Supply Chain Reality: High-precision quartz crystals and ceramic antennas for GPS are specialized components with a concentrated manufacturing base in Asia. Long-range digital radio transmission technology is a highly competitive sector dominated by a few key players globally.

4. Power and Structure

Lithium-polymer batteries and carbon fiber frames form the foundation.

- Supply Chain Reality: While lithium is mined globally (Australia, Chile), the refining and battery cell production capacity is vastly concentrated in East Asia. Similarly, high-quality carbon fiber manufacturing requires significant industrial infrastructure.

The Shifting Landscape: From Concentration to Diversification

For the past decade, the drone supply chain has been characterized by extreme geographic concentration. The "Shenzhen effect" meant a manufacturer could source everything from the frame screws to the flight controller within a 50-mile radius, enabling rapid prototyping and low costs.

However, reliance on a single geographic region creates vulnerability. Geopolitical tensions, trade tariffs, pandemics, and shipping logjams have awakened the industry to the need for supply chain resilience.

Today, the trend is toward diversification and "China Plus One" strategies. Manufacturers are looking for upstream alternatives outside traditional hubs to mitigate risk and ensure compliance with emerging regulations in Western markets (such as NDAA compliance in the US).

Spotlight on Thailand: An Emerging Upstream Drone Hub

As companies seek alternatives for manufacturing and assembly, Southeast Asia is emerging as a formidable contender. Thailand, in particular, is rapidly positioning itself as a key upstream hub for the drone supply chain, leveraging decades of industrial experience.

Thailand is moving beyond simple assembly and into higher-value component production for UAVs.

1. Advanced Composite & Frame Manufacturing

Thailand has a massive, established automotive manufacturing industry (often called the "Detroit of Asia"). This has fostered a deep ecosystem of suppliers skilled in working with carbon fiber, fiberglass, and complex injection molding.

- The Advantage: These skills are directly transferable to manufacturing lightweight, durable drone airframes, landing gear, and propeller systems at scale, offering a viable alternative for structural components.

2. Electronics Manufacturing Services (EMS) and PCBA

Thailand is already a global powerhouse in hard drive manufacturing and automotive electronics. The country possesses mature infrastructure for Printed Circuit Board Assembly (PCBA).

- The Advantage: For complex electronics like power distribution boards, carrier boards, and ESCs, Thai EMS providers offer high-quality production standards, skilled labor, and established logistics channels that rival traditional North Asian hubs.

3. Final Assembly and Integration

The complexity of wiring a modern drone requires skilled technicians. Thailand’s labor force is highly experienced in complex electro-mechanical assembly derived from its auto and electronics sectors.

- The Advantage: Thailand offers a stable environment for final integration, testing, and packaging of complete drone systems, providing a crucial "Made in Thailand" option for global markets seeking diversified origin points.

Conclusion: Building for Resilience

A wiring diagram tells you how to connect the parts; supply chain intelligence tells you if you will have the parts to connect.

The future of successful drone manufacturing lies in modularity—designing systems around standard interfaces (like CAN bus or Ethernet) that allow swapping suppliers if one source dries up. It also relies on looking beyond traditional manufacturing hubs. By integrating emerging players like Thailand for frames, electronics, and assembly, drone companies can build the resilient supply chains necessary to navigate the uncertainties of the global market.